Share

By enforcing compliance with the Digital Tracking System (DTS) and the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) in the Kampala Central Business District (CBD), the Uganda Revenue Authority (URA) has successfully collected UGX 6.8 billion within a week.

In charge of these operations is Sandra Kaitare, Assistant Commissioner of the Petroleum and Mining Division, who disclosed that the large sum is made up of fines paid to those who violate both systems.

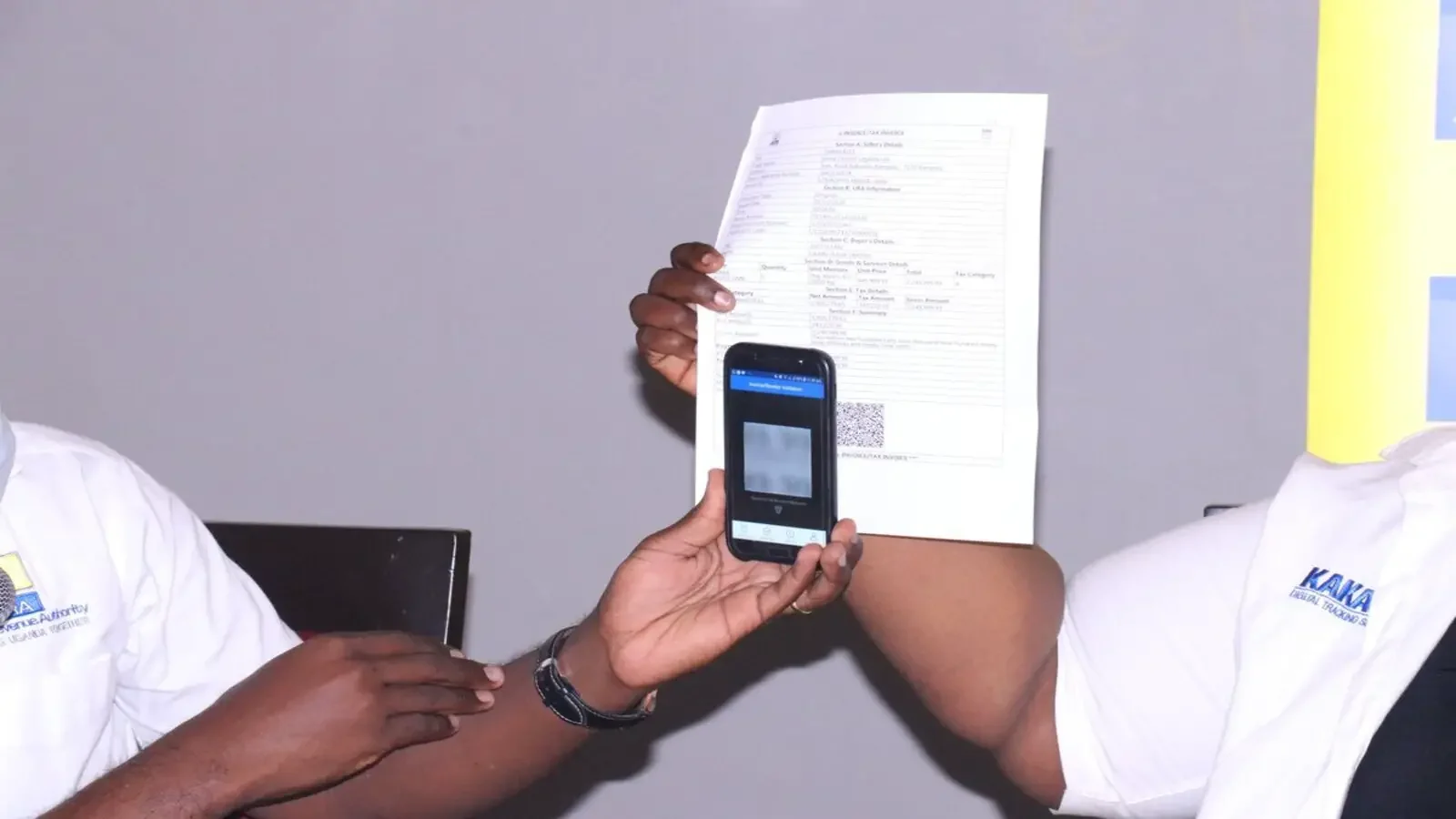

In order to improve revenue collections, Kaitare emphasized the significance of EFRIS and the need for VAT-registered taxpayers to issue accurate invoices. The purpose of DTS enforcement is to make sure makers and manufacturers activate the stamp; non-compliance will result in sanctions. The URA tax education team has been teaching taxpayers about DTS and EFRIS, highlighting the advantages of compliance and the severe penalties for non-compliance.

VAT taxpayers who violate EFRIS may be subject to a monthly penalty of UGX 6 million; for unstamped products, DTS infractions may result in a penalty of UGX 50 million. Products without stamps are likewise subject to a fine of Shs. 50 million. According to Kaitare, the ultimate purpose is to enable the regular flow of business, even while sanctions are implemented in order to achieve taxpayer compliance.

Because of their strong commercial linkages, the CBD, Uganda’s main business core, and its surrounding districts have been given enforcement priority. To monitor goods traveling to and from the CBD, foot soldiers have been stationed at checkpoints across the country, such as the Mbarara Bridge, Jinja Bridge, Karuma Bridge, Pakwach Bridge, and Mityana Checkpoint. DTS compliance is strictly monitored, and goods lacking clear e-invoices are detained until compliant invoices are issued.

The goal of the six-month enforcement campaign, which started with 201 officers, is to ensure widespread taxpayer compliance and improved business flow.