Share

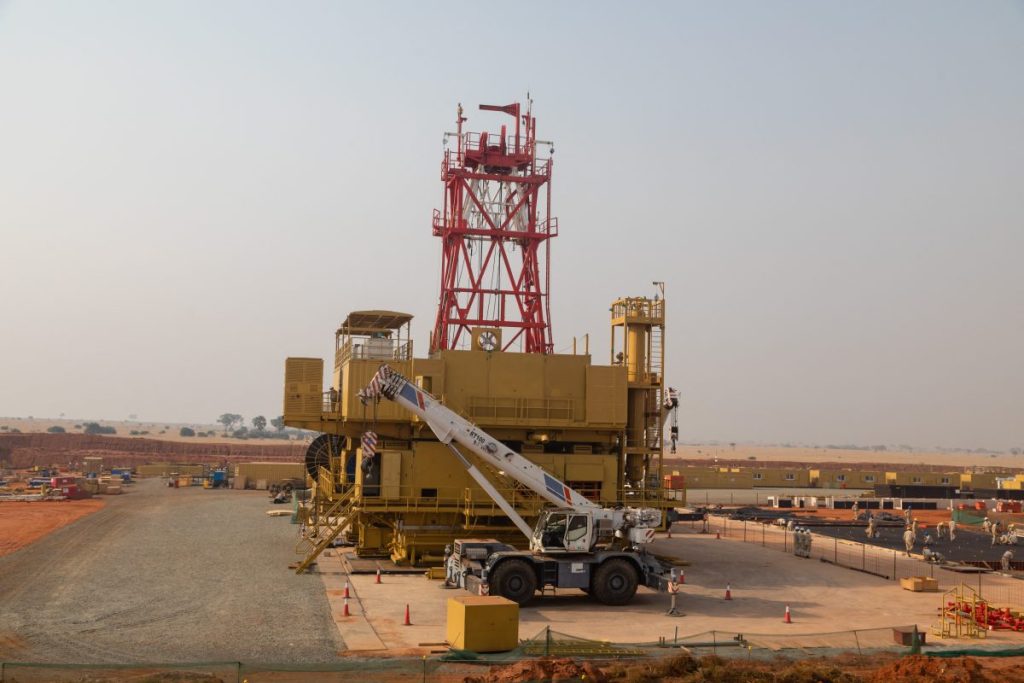

The Ugandan oil and gas project has now begun in full swing after encountering various difficulties such as tax disputes, local content rules, and environment-related demonstrations. The sector’s association of service providers has altered its emphasis from avoiding involvement in the sector to carrying out awarded contracts.

Service providers may no longer bemoan a lack of engagement thanks to government efforts. Most service providers now have a better understanding of the project’s requirements and the difficulties in project management and implementation after two years of work on it. The oil industry has turned out to be more complex than originally thought.

Service providers started to confront the hard realities of their involvement as they moved from seeking out tenders to winning them. It is important to note that the majority of regional service providers have performed admirably, overcoming challenges and completing projects on schedule and within budget. This refutes the claim that local businesses are undercapitalized.

However, there have been problems along the road. The delayed payment of invoices is one significant worry. Although contracts usually have a 45-day payment deadline, several invoices have gone unpaid for more than 100 days. Contractors have experienced issues as a result of these delays, which have made it impossible for them to pay their own suppliers and resulted in loan defaults. This not only has an impact on the contractors themselves but also casts a bad light on the banking industry and prevents the sector’s expansion. Local content would suffer if this condition persists, which will result in foreign enterprises dominating the sector and capital flight from Uganda.

The modest amount of advance payment given to contractors is another problem. Without obtaining full payment up ahead, contractors are expected to finish projects; they then have to wait 45 days before being reimbursed. Some businesses have now faced difficult circumstances as a result, particularly those with no prior expertise in the industry. Additionally, the absence of upfront payment makes it challenging for contractors to obtain bank funding.

These difficulties affect the banking industry in addition to contractors. Banks are unable to build new facilities in other industries because they must set aside money for these overdue loans. Youth employment gains have been reversed as a result of employee layoffs brought on by contractors’ lack of operating capital. In conclusion, late invoice payments have a significant impact on the oil and gas industry as well as the overall economy.

As an organisation, we ask Petroleum Authority of Uganda, as the regulator and the International Oil Companies to address these issues swiftly. Our aim is that these challenges be handled so that we can fulfill the vision of a robust economy powered by Ugandans.